Market upgrades is a key topic for investors and a strategic goal for any financial market, government, or country. An upgrade not only strengthens the image of a country’s financial market but also enhances competitiveness and attracts foreign investment. According to the World Bank, if upgraded, Vietnam could attract up to an additional USD30 billion in foreign investment by 2030. However, the upgrade has yet to be approved. This article will analyze the reasons why Vietnam has not yet achieved an upgrade, as well as the limitations and challenges that remain in this process.

Market upgrades is a key topic for investors and a strategic goal for any financial market, government, or country. An upgrade not only strengthens the image of a country’s financial market but also enhances competitiveness and attracts foreign investment. According to the World Bank, if upgraded, Vietnam could attract up to an additional USD30 billion in foreign investment by 2030. However, the upgrade has yet to be approved. This article will analyze the reasons why Vietnam has not yet achieved an upgrade, as well as the limitations and challenges that remain in this process.

For the last few months, there have been heated discussions and forums not just among private institutions but also among government authorities. Private institutions and the Vietnamese government have also worked together to analyze and propose solutions to urgently move Vietnam’s stock market from a frontier market to an emerging market. This is not a new topic but rather has been smoldered for years. We have decided to gather and offer a clearer status of what is happening and the prediction of when Vietnam’s stock market can become an emerging market.

Vietnam’s stock market has made significant strides, moving from a frontier market to the watchlist of becoming an emerging market since 2018, however there are still factors preventing an upgrade. Despite Vietnam’s significant weight in the Frontier Market, being stuck in a frontier market list has limited its growth and potentials. An upgrade would surely provide more room for expansion, attracting additional foreign investment and boosting the local economy, and benefiting investors, businesses and the entire ecosystem.

Vietnam remains a frontier market despite strong performance since 2018

Financial Times Stock Exchange Russell (FTSE) and Morgan Stanley Capital International (MSCI) are the two institutions who play significant roles in classifying and tracking the performance of frontier and emerging markets through their indices. FTSE provides indices like the FTSE Frontier Index and FTSE Emerging Index. MSCI offers MSCI Emerging Markets Index and the MSCI Frontier Markets Index. These indices help investors gain exposure to these markets and make informed investment decisions.

Vietnam was added to the watchlist of FTSE in September of 2018, for a reclassification from “frontier” market status to “emerging” market status. Since then, FTSE Index reports indicate that Vietnam has consistently outperformed the FTSE Frontier Market Index and is virtually in line with the FTSE Emerging Market Index in terms of performance.

Vietnam’s stock market has also advanced and dominated the frontier market, holding about 27% stake of MSCI Frontier Market Index as of the end of January 2024, ranking Vietnam number one out of 23 countries in terms of market capitalization. However, Vietnam is still not yet on MSCI’s upgrade consideration list, which is scheduled for June next year.

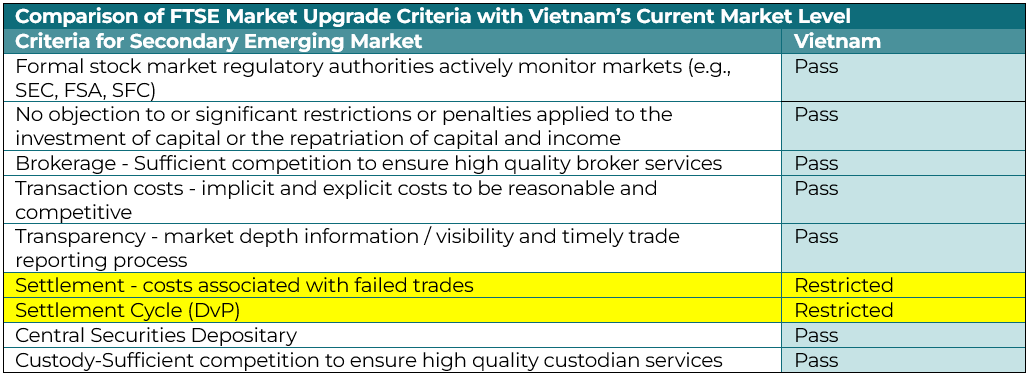

Despite Vietnam’s exceptional market performance, Vietnam’s market status has not been upgraded to emerging due to a handful of operational and legal factors, including foreign ownership limits, equal rights for foreign investors, information and market regulation disclosures in English, and pre-funding requirements. These limitations are critical for both the FTSE and MSCI not satisfied to classify Vietnam’s as an emerging market.

Still an early stage with a handful of limitations to foreign investors after 24 years

When foreign ownership limits are reached for a stock, foreign investors are forced to trade amongst themselves, resulting in inflated prices for the stock. It becomes a problem when for example, many of the top publicly traded companies in Vietnam are currently banks, which has a maximum of 30% for total foreign ownership limit.

Besides foreign ownership limits, essential information and market regulation disclosures are often in Vietnamese, without English translation. Foreign investors do not have sufficient information to make informed investment decisions and ultimately are deterred away. Vietnam’s stock market also requires foreign investors to have 100% of funds available when making a trade, an unusual requirement compared to other markets, which have caused investors to often miss lucrative opportunities.

Government officials committed to improve through legal and technological reforms

The Ministry of Finance, along with the State Securities Commission and relevant ministries and sectors, is actively promoting regulatory reforms to elevate Vietnam’s stock market. Recently, the Ministry of Finance issued Circular No. 68/2024/TT-BTC, requiring large and listed companies to disclose periodic information in English starting from January 1, 2025. From 2028, all listed companies on the stock exchange will also be required to disclose both periodic and extraordinary information in English. Furthermore, this circular allows foreign institutional investors to purchase shares without needing sufficient funds in their accounts, thereby addressing the pressing issue of “pre-funding” that has been a challenge in recent times.

Foreign ownership limits remain to be an issue that has not been thoroughly addressed although it has been a hot topic of discussion recently. However, industry experts predict that Vietnam will refine its legal framework and begin to widely implement Non-Voting Depository Receipts (NVDR) in the near future, allowing foreign investors to purchase shares of publicly listed companies without gaining executive control. NVDR has been defined and mentioned in the 2020 Enterprise Law, but there are still no clear regulations for the listing and trading of this instrument in the market. In addition, the State Securities Commission (SSC) is also calling for contributions and proposals to amend the Securities Law and related laws in order to improve and better support the market.

An upgraded market status will boost the local economy and benefit investors, businesses and the entire ecosystem

Experts from the World Bank Group estimated that the upgrade of Vietnam’s stock market status to emerging can attract an additional USD30 billion from foreign investors in the subsequent five to seven years. A great inflow of foreign investment will provide domestic businesses with an abundance of new capital and create new jobs for the local economy. Foreign investors can expect greater returns as Vietnam acquires new capital and an increased global presence from being part of MSCI and FTSE Russell’s Emerging Index. The market will also have higher liquidity, reducing transaction costs and time.

Not only boosting public equity activity, but the upgrade of Vietnam’s stock market status is expected to also have a notable impact on the private equity market. With an emerging market status, Vietnam will likely attract more institutional investors and private equity firms, who look for higher returns in a growing economy. As investor confidence grows with Vietnam’s upgraded status, fundraising for private equity funds focused on Vietnam or Southeast Asia will become even more attractive. As private equity investors often seek profitable exit strategies, a thriving stock market with improved liquidity and fueled investor interests will provide better opportunities through initial public offerings (IPOs) or secondary market sales.

The path of roses but also thorns

We expected a lot more to be done in order for Vietnam’s stock market to achieve the emerging status. An upgraded market status with additional foreign capital inflow coming in is a strong incentive for the government and market participants, however it still takes time for the SSC and the government to understand, learn best practices and apply to govern as they aim to also secure its financial market stability and sustainability, especially for the limitations related to regulations and government actions.

Vietnam’s market upgrade timeline remains uncertain

While Vietnam’s government has set to reach emerging status for its stock market by 2025 and been working towards meeting the criteria set out by both FTSE Russell and the MSCI, official timeline for completing these criteria has not been announced. Given the remaining criteria mentioned above, we predict that Vietnam will need at least 1-2 years to achieve this upgrade according to FTSE’s criteria and about 3-5 years according to MSCI’s criteria.

Authors

This article is written by Nghi Truong, Robert Rosado, and has been peer-reviewed (the “authors”). It is part of our Views and Analysis series, where colleagues from various disciplines, functions, and levels share their expertise, studies, observations, analysis, and views relevant to our work and clients.

Sources

The information, data and figures are from the State Bank of Vietnam, Ministry of Planning and Investment, and Federal Reserve Economic Data and the author’s analysis.

Disclaimers

The above article represents the views of its authors and is for informational purposes only. It is not intended to serve as advice or recommendation, nor to address the circumstances of any entity, individual, or matter. No one should rely on and/or act upon the information presented without obtaining appropriate professional advice from ASART.

ASART and the authors accept no liability for the content of this article or for the consequences of any actions taken based on the views and information provided.

Where the article contains statements, estimates, and projections regarding the anticipated future performance of Vietnam, markets, companies, and related figures, such statements, estimates, and projections may or may not prove to be accurate. No representation or guarantee is made regarding the accuracy and completeness of the content presented.

Any person or entity using this article to form a discussion, make decisions, or take any actions must satisfy themselves as to all relevant matters, including all the information and statements contained in this article, and must rely upon their own enquiries, investigations, and judgments, not upon the information and statements contained herein.

ASART and the authors do not accept responsibility for any information contained herein and disclaim all liability to any entity, person, or matter arising out of or in connection with this article.

About Us

ASART is a leading boutique advisory firm providing comprehensive management advisory services in corporate finance, corporate strategy, and wealth management. We focus on mergers and acquisitions (M&A), strategic synergies, investment returns, and sustainable growth.

ASART closely monitors market trends and changes to deliver trusted, world-class expertise, practical experience, and independent local insights to leading multinational corporations and Vietnamese companies aiming to grow their global presence and succeed in Vietnam and Asia.

We have a strong network of high-performing companies and reputable investors across a wide range of industries, including manufacturing, healthcare & pharmaceuticals, building & construction, real estate, transportation & logistics, banking & financial services, retail, education, infrastructure, media, and energy.

Our insights help you make informed decisions, solve problems, and gain new perspectives. Our execution, experience, and in-depth market understanding have assisted many clients in solving their most difficult problems, forming the right strategies, finding targets, connecting with investors, and closing deals successfully. Our services are unparalleled and recognized as top-notch.

Contact us at contactus@asart.com.vn or +84 28 3821 6166 for more market insights and see how we can assist your business!